Modern Marketing Dilemmas: How Should Marketers Stand Up To Recession?, By Kantar’s Mary Kyriakidi

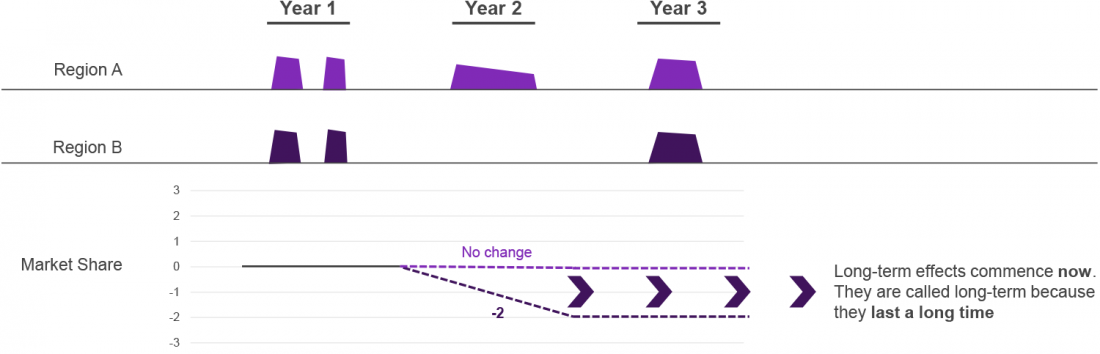

A leading UK beverage brand with a stable market share decided to go dark for a year (Year 2) in region B while continuing to invest in region A. The effects of this choice of direction for their marketing during the recession included:

- Market share declined by 2 percentage points in region B where no investment was made, while it remained stable in region A. In practice, the main effect of most media investments is to maintain market share rather than increase it.

- The resumption of marketing investment the following year (Year 3) did not recover the lost market share.

- The long-term for the brand was crippled.

The message is clear: Short-term losses and gains have a long-lasting effect, and the cumulative impact of going dark can be devastating for a brand’s future profitability.

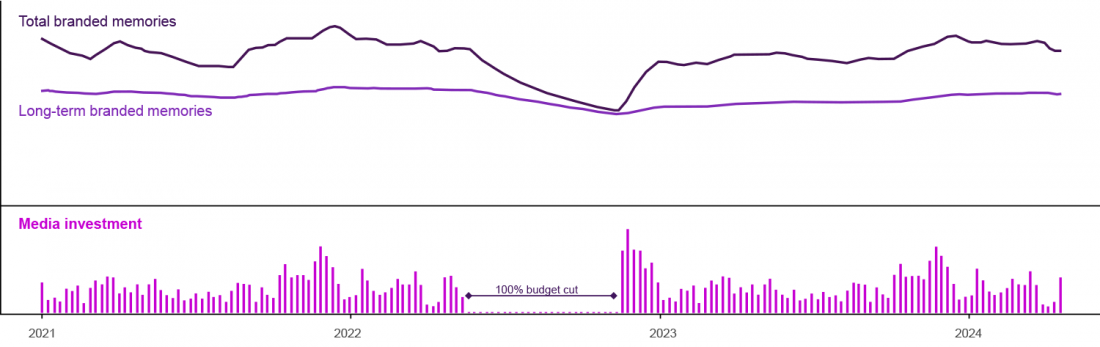

Case study 2: Serious long-term consequences of drastic budget cuts

A leading German telecommunication brand was under pressure to reduce or eliminate all media investments by mid-2022. Using time series regression to model branded memories of media investment to understand efficiency, we simulated the likely impact of going dark for six months. We concluded that:

- The decline is strong for both short-term and long-term memories.

- Recovery is possible but would require additional investment and several months.

The message again is clear: It will take a long time – and require more media investment than before the downturn – to repair the damage to long-term memories and long-term sales caused by the advertising disruption.

Regrets from ASOS over a lengthy period of under-investing in their brand and elation from Airbnb over their ‘strongest ever’ fourth-quarter results hit the headlines in recent months. The moral of both stories is that continued investment in brand-building advertising is hugely beneficial to brands in the long term.

2. Keep calm and pursue the market share you want

There is enough empirical evidence to assert that brands with a share of voice (SoV) greater than their market share (SoM) tend to grow. Conversely, brands with a SoV smaller than their SoM tend to decline.

Analysis of the IPA DataBank by Les Binet and Peter Field suggests the growth rate of brands over time is proportional to the difference between SoV and SoM. This is usually called extra share of voice (eSoV).

By how much exactly?

We’ve analysed the impact of eSOV in hundreds of categories around the world in order to evaluate the impact of eSoV on brand growth in a recession:

- Some categories are very sensitive. For example, a European drinks category where for every 10 points of eSoV a brand can expect 1.52 percentage points market share growth per annum.

- Most other categories are a lot less sensitive. On average, a brand would need to sustain an eSoV of 20 points to drive market share growth of 1 point per annum.

This illustrates how slowly market share responds in most cases to communication – and why it is so important to measure long-term effects. As I mentioned before, media investment largely aims to maintain market share rather than grow it.

Clever marketers aiming for ambitious market share growth will hope to outperform this average by making their budget work harder with stronger creative and better media deployment.

Most companies spend 8%-12% of their revenue on marketing. But this benchmark is easily broken by businesses aiming higher. If like me, you opened your eyes widely at the news that ByteDance (parent company of TikTok) spent $19bn (31% of its revenue) on marketing, it’s because they aim for the moon; going after the market share they want rather than what their growth trajectory indicates.

Evidence confirms that media spend plays a crucial role in gaining and losing market share. A data truth that is even more valid during a crisis, when one’s spend will likely be filling awkward silences from their competitors. Alex Biel and Stephen King provide the evidence. They analysed consumer businesses in the Profit Impact of Modern Strategy database during recessionary and growth times and found that their gains were greater during the former. With an increased ad spend by more than 20% these brands gained +0.9 SoM during recessionary times vs. +0.5 SoM during growth (expansion) times. “In other words, the possibility of gaining share through increasing advertising appears to be greater when the total market is soft.”, as they say.

The case of food manufacturing conglomerate Kellogg’s gaining dominance in the cereal market during the Great Recession is well known; Kellogg’s doubled its ad budget whilst Post – their competitor – cut it back. But more recently, during the pandemic, the cases of P&G and Coke re-affirmed this theory – both brands kept their marketing investment in and saw a significantly better share of voice as a result.

3. Keep calm and stay focused on profits

Profit is not a dirty word, not even in inflationary times. And although many of us feel somewhat infuriated by the growing cases of profiteering vs. profit, my clarity on the role of the marketer remains intact.

Great marketing leads to great profits. The stronger the brand, the higher its pricing power, and the more margin it makes. And it’s not just us saying so. Using the IPA dataBANK, Binet and Field have proven that investing in eSOV during a recession will drive long-term profit, also that by making ‘reducing price sensitivity’ your campaign objective (vs. share gain or share defence), the profit gained will be much greater by comparison.

But how can a brand maintain its pricing power during a time that consumers are looking for price reductions?

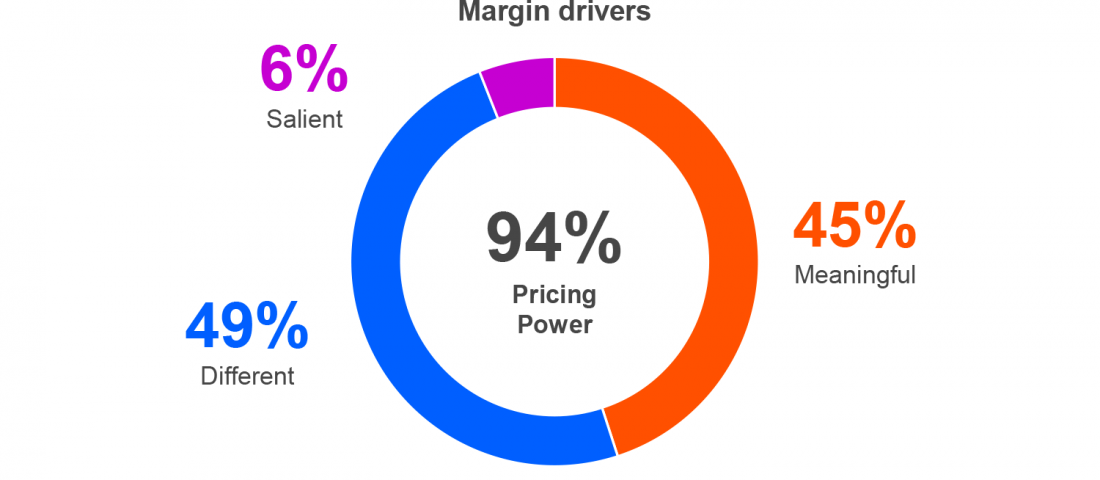

We found the answer in our Meaningfully Different framework (MDf), a framework designed to measure the different dimensions of a brand’s equity. Pricing Power is the offspring of Meaningful, Different and Salient, put together in precise quantities. Meaningful Difference accounts for 94% of a brand’s pricing power whilst salience contributes with a mere 6%.

Meaningful Difference drives Pricing Power

So, how does this affect how you plan your marketing during a recession?

- The more a brand is perceived as different, in addition to the belief that it stands for something, the more valued it is.

- People are not looking to cheapen every aspect of their lifestyle, and as they prioritise, meaningfully different brands stay at the top of the list.

The case of Unilever stands out here. For over a century, they’ve been creating brands that people want to buy and are willing to put in consumers’ safe bucket. Whilst they could easily play in the commodity business, they waltz elegantly in the brand business. Their recently released quarterly results further validate the concept of Pricing Power and its direct link to healthy margins.

Make the move from price to value

Paying is not an apathetic affair for humans. We feel pain every time we pay for something. Behavioural scientists call this ‘the pain of paying’, a pain which becomes more acute as the cost-of-living rises.

Businesses, on the other hand, feel a different kind of pain. As they are challenged to safeguard their profits as costs increase rapidly, some resort in shrinkflation tactics. They offer the same packaging but with less product in the forlorn hope that consumers won’t notice. They always do, by the way, even if not instantly.

Others have taken a different path in times of turmoil. Genki Forest, for instance, decided to go after a younger audience through its healthy positioning and developed new products with 0 sugar, 0 calories and 0 fat in half as much time as their competitors. Maggi and KFC India collaborated to deliver their fusion bowl of popcorn chicken and noodles bringing double the value to consumers with their successful partnership. Cafu has created a completely new re-fuelling option for motorists, saving them time and effort.

The examples of brands that have proudly demonstrated what makes them special and relevant in the consumers’ lives are many. They’ve positively levelled with the consumer’s thrifty mindset and spoken with clarity about their tangible benefits, that surplus value they are bringing when it’s needed most. They’ve exhibited empathy and consumer understanding and have proven that growth in recession really is possible.

It’s not a contradiction; brands can maintain their Pricing Power in ways that are also affordable to consumers. By focusing on your brand as a value producing asset, you align your interests to those of the consumers’. Because consumer choice will always tilt towards brands that are meaningfully different, both now and in the future.

From helping you to navigate risks with proactive investment to showing you how to use today’s trends to improve in the future, we’ve got everything you need to be successful when marketing in difficult times. Watch our on-demand webinar – Under Pressure: What marketers need to know now for strategic planning – to find out more about how to navigate social and economic challenges.

This article has been originally published on Kantar