Consumers prefer their ads on TikTok while marketers prefer YouTube

Hot off the press from Kantar are the results of the world’s first global ad equity ranking, which measures consumers’ attitudes towards advertising in different environments. TikTok, the social media platform at the centre of global attention, tops the inaugural ranking.

The Media Reactions study surveyed 4,000 consumers and over 700 senior marketers and provides an overall ‘ad equity’ metric* for select media channels as well as social media and content-led media brands. Detailed diagnoses also help advertisers understand the impact different platforms will have on their ads and their brands and highlights the dichotomy between marketers’ preferences for established digital platforms while consumers prefer newer platforms.

Findings from the study include:

The online-offline divide

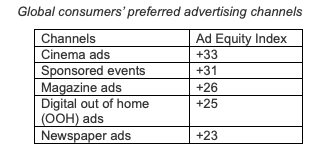

Consumers prefer offline channels for advertising, which they tend to view as better quality, more trustworthy, less intrusive, and less excessively targeted than online channels. Overall, the media channels where consumers claim to prefer advertising are:

- Cinema tops the list in 4 of the 7 measured countries while sponsored events lead the ranking in Brazil and China. Print media and digital OOH ads also rank highly with consumers.

- While online formats are generally less popular than offline formats, attitudes are more favourable among consumers of influencer-branded content, podcast ads and streaming-TV ads.

- Across all formats, TV and video advertising continue to dominate ad exposure. While our study explored a variety of environments, consumers clearly have passionate and somewhat polarised views across formats. The study uncovers that some are considered fun, good quality, relevant and trustworthy, while others are disliked for their saturation and repetition.

- Despite consumers’ preference for offline ads, the focus of the marketing community remains on digital engagement. Marketers’ platform priorities are therefore at variance with consumer preferences. Industry preferred ad platforms are (in order) online video ads, TV ads, social media news feed ads, streaming TV ads and social media stories.

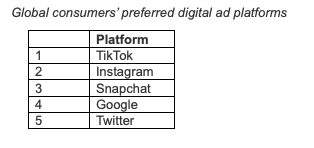

Global Digital Platform Ranking

Across a selection of global digital platforms, Kantar also measured consumers’ views on advertising in the social/content platforms they use. Based on 11 variables, TikTok gained the highest global ad equity rank. The top five ranked digital media brands for advertising are:

Within the digital environment, consumers and marketers agree on trusted digital platforms such as Google, Instagram and Twitter. However, consumers are generally more positive about advertising in newer platforms such as TikTok, while marketers prefer more established brands such as YouTube.

In contrast to the overall channel rankings, ad equity is generally higher for the global digital media brands than for local (offline heritage) media brands. It seems that the ’general failings’ of online ads are less of an issue for most of the premium digital environments included in our study.

Discussing their success in the Ad Equity rankings, Jorge Ruiz, Head of Marketing Science at TikTok commented, “We are humbled and honoured to have topped this insightful Kantar ad equity ranking. We take great pride in helping advertisers deliver their brand messages to the TikTok community in a meaningful yet respectful way which reflects the authentic content experience of the TikTok platform. We hope that this recognition helps to further energise our creative partners on the journey to make even more amazing TikToks.”

Ad Spend Outlook

During the COVID-19 pandemic, 60% of businesses report having reduced their marketing spend, with 30% having reduced it a lot. The pandemic has resulted in a greater focus on brand purpose and digital transformation. Perhaps as a consequence, marketers now rate campaign appropriateness and advertising receptivity ahead of ROI and cost considerations when making their media budget decisions.

Spending shifts have largely been in line with consumers’ changing media habits, which during the pandemic became more online than before. Budget/resource allocation to digital channels has increased as a result of COVID-19. Investment in offline media has declined in response to the lockdown across most major societies.

The shifts of 2020 look set to accelerate further in 2021, especially for online video. The global platforms most likely to benefit are YouTube, Instagram, TikTok and Google. TV is expected to bounce back along with digital OOH. For most other offline media 2020’s challenging business environment looks set to continue into 2021.

Planned changes in budget/resource allocation (change to planned net increase)

“It is increasingly important to understand where great ads thrive,” commented Duncan Southgate, Global Brand Director, Media, Kantar. “Our research shows that consumers have differing receptivity to advertising across different media channels, platforms and formats. The rush to digital is understandable because of targeting and measurement capabilities, but saturation, repetition and over-targeting in some environments can make this counterproductive. Advertisers and agencies need to develop a more quantified understanding of ‘medium as message’ and the impact different media channels and platform choices can have on their brand goals. Media platforms need to manage the equity of their advertising offer with both consumers and marketers in mind. This means delivering regular innovation in advertising formats to satisfy marketer needs, while still keeping consumers entertained and paying attention.”

Join the conversation on LinkedIn and Twitter to keep up to date with our comms, and sign up for our newsletter Inspiring Growth, that shares the weekly round up of our best insights.