Amazon is the global media brand in which consumers enjoy ads the most, this according to Kantar’s Media Reactions 2022, the third edition of their global Ad Equity ranking of media channels and media brands. Adverts on the Amazon platform were cited by consumers as more relevant and useful than others, and is has also been named as Egypt’s most preferred ad platform.

Key findings from the study include:

- For the third consecutive year, traditional advertising platforms dominate the ranking of formats that consumers favour the most.

- In the digital world, influencer content replaced podcast adverts as the preferred advertising format.

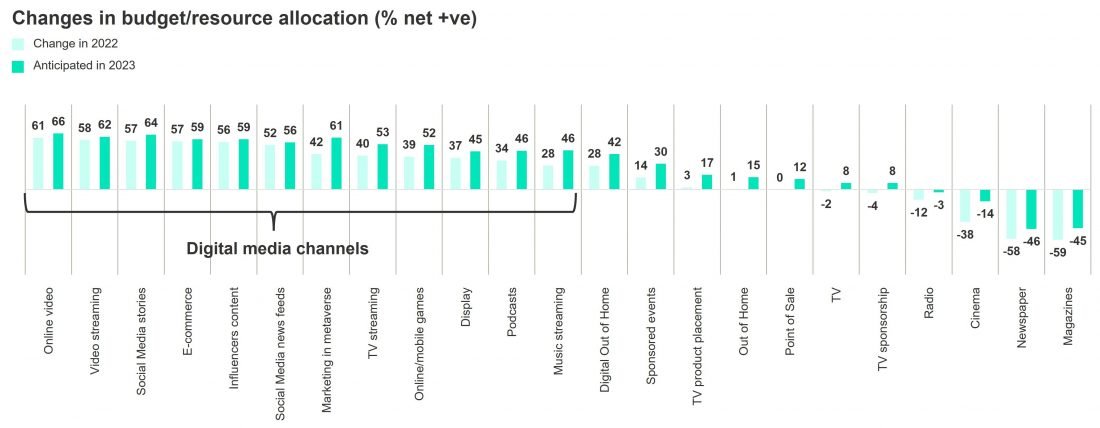

- Despite consumers’ preferences for offline platforms, marketers continue to favour online platforms. More advertisers say they will increase spend on online video in their advertising budget allocations in 2023, as TikTok continues to be regarded as the most innovative media brand.

- A net 61% of global advertisers plan to increase their spend in the metaverse in 2023.

Top ranking media channels

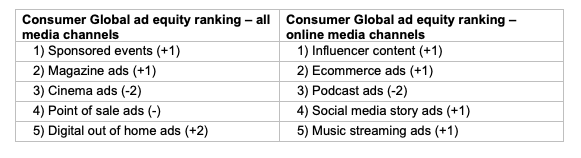

Kantar’s Ad Equity metric uniquely identifies the places where consumers most appreciate advertising and are least likely to view ads negatively. Across all media channels consumers are most positive about advertising in sponsored events (#1), in magazines (#2) and cinema (#3). Ad equity for almost all online channels increased this year, continuing the trend since 2021.

Within the digital environment, influencer content leads the way as the preferred ad format, with a six point jump in ad equity, followed by ecommerce and podcast ads. Social media story ads and music streaming ads both improved one position in comparison to last year’s results.

Global digital media brands

Amazon leads the overall Ad Equity ranking among the nine digital media brands measured globally in 2022. People find ads on Amazon relevant, useful and of better quality, making it the most popular ad platform among consumers this year. Amazon advertising is also the most preferred brand locally in four markets: Germany, Italy, Egypt and Colombia, and in the top five in four other markets.

TikTok, the #2 digital brand for Ad Equity, continues to be perceived as innovative and more fun and entertaining than other digital media brands. Spotify jumped four places to reach #3, representing the constantly growing music streaming channels and podcast. Spotify’s strength mainly comes from the perception of quality ads and consumers’ willingness to accept the advertising in the platform. It is placed at #1 in Vietnam, and in the top 3 in Japan and Korea.

Marketers ranked Instagram, for the second year in a row, as their number one preferred media brand, followed by Google (#2) and YouTube (#3). This year, TikTok has moved three spots in preferences among marketers, to reach fourth position. 84% of marketers plan to spend more on TikTok in 2023; more than any other global ad platform.

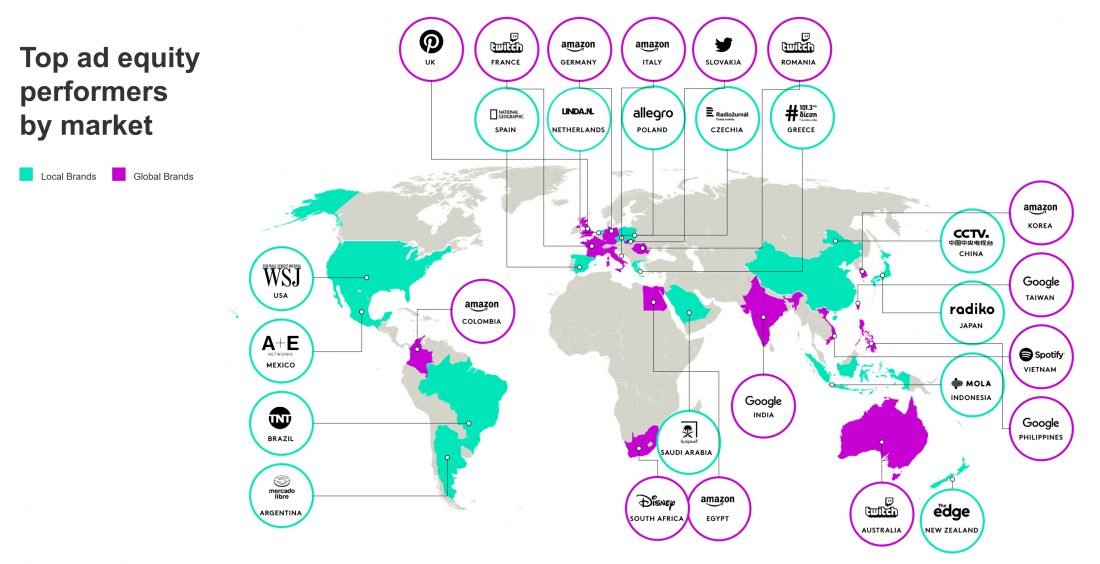

Top ad equity performers by market

In contrast to last year’s results, consumers’ preferences have divided equally between global and local media platforms. Across 29 surveyed markets, global giants such as Amazon, Google, Twitch, Spotify, Pinterest and Disney were identified in 15 countries as the preferred platforms. Fourteen of the top advertising performers – from a consumer perspective – around the world are local or localised media brands.

Ad spend outlook

Digital media spend is expected to continue increasing in 2023. Online video, video streaming and social media stories are the top 3 channels with a net increase in budget allocation in 2022 and 2023, followed by marketing in the metaverse, which marketers say they will increase by 61% in 2023.

Commenting on the findings Jane Ostler, EVP, Creative and Media solutions at Kantar, added “The media environment continues to evolve rapidly and, in inflationary times, marketers need to make careful choices. Marketers continue to be lured by the siren call of the new and shiny, such as embracing attention as a new metric and the metaverse as a new channel – but it is imperative to maintain a holistic understanding of ad platforms and what consumers think of them.”

Rana Mokhtar, Brand, Media and Communications Director, Egypt, at Kantar, concludes “The competition is getting tougher between online and offline – TV is losing trustworthy perception while Digital is showing higher potential and investment from a marketeer’s point of view. Online and offline gaming is one of the key trends that is growing recently in exposure, mainly amongst the youth.

Want more? Catch the highlights package in our free webinar and download the full report at kantar.com/mediareactions.