By: Sarosh W. S., Head of Digital at Mindshare UAE

Co-authored by: Romel El Bittar, Planning Director at Mindshare UAE

The content and entertainment industry are in a constant state of evolution. New industry players, on-going shift in consumer expectations, algorithms that personalize content, faster internet speeds, new technology and innovative streaming platforms are all active contributors to the ever-changing dynamics of this industry.

The device agnosticism, convenience and affordability of on-demand video delivery platforms today has challenged the legacy of free-to-air TV channels, leading to screen and platform wars competing for consumers’ share of entertainment.

The Screen Wars: AVOD/SVOD vs Linear TV

While one narrative supports the rising influence of digital screens and high smartphone penetration in MENA, particularly in the GCC, where today people also have access to work and personal PCs, and laptops. This fragmentation of screen time leaves limited hours for people to spend in front of Linear TV vs how it used to be a few years ago, and creates more opportunity for AVOD, SVOD and other on-demand entertainment platforms.

The other narrative focuses on the strength of free-to-air channels like MBC and Rotana, and the influence, scale and mass reach that linear TV promises for advertisers in the region. In recent years, linear TV groups have invested heavily behind impactful content by bringing in big format shows to the region, retaining exclusivity of top shows during Ramadan, and embracing data and technology with the introduction of performance TV metrics, in order to reduce a potential advertisement revenue loss to performance driven channels such a search, social and programmatic.

“50% of the entertainment category is driven by price, 44% is driven by content, whereas only 6% is driven by loyalty”

-BrandZ

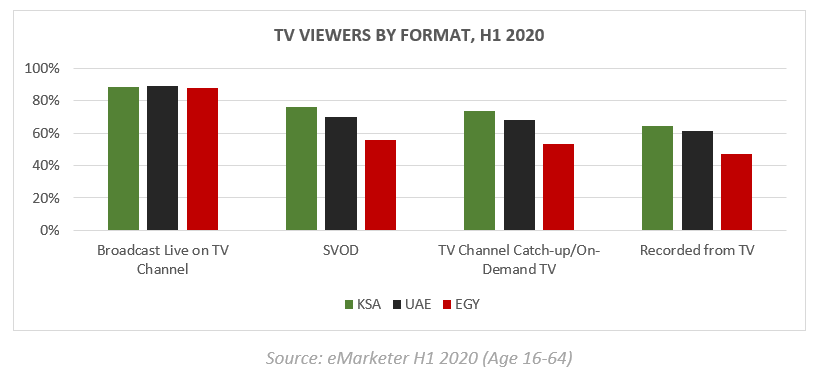

If we look at a percentage of TV Viewers across KSA, UAE and Egypt, Broadcast Live TV still dominates TV viewership across the 3 markets with close to 90% of the internet users claiming to watch it. However, SVOD is a close second average at about 70% for UAE, and 76% for KSA. SVOD for Egypt is at about 47% which is significant in terms of volume.

Audience fragmentation is not linear anymore

Despite the value that each of the two TV platforms have to offer to their viewers, one reality is certain. The audiences are becoming more fragmented than they have ever been before. The consumers’ entertainment preferences branched out from one TV one channel households to multiple channels and eventually to multiple TVs in a single household over a decade or two ago.

Fast-forward to today where each individual’s social newsfeed and Netflix profile is constantly being personalization through automated algorithms – as the suggestive technology gets smarter with time, even spouses will not grow old together having the same values and preferences years down the line.

That is audience fragmentation on steroids.

The drivers of viewership for entertainment platforms

On one end of the spectrum there is Linear TV which has been driven by aggregated viewing behaviour with family and friends around exclusive content, seasonal shows (e.g. Ramadan), live events and sports. On the other end you have individual viewing behaviour driven by personal preference, “me-time,” and exclusivity of content.

The common thread across both platforms remains – exclusive content, which, how we see it, will continue to dictate consumers’ entertainment choices. A survey by BrandZ for the entertainment category from respondents in UAE and KSA further points to the evidence through category drivers: 50% of the entertainment category is driven by price, 44% is driven by content, whereas only 6% is driven by loyalty.

This establishes a clear route forward, the free-to-air channels will maintain their reign in the near future with their local and regional affinity as well as their ability to reach a large audience across the MENA region. However, SVOD platforms with their low subscription costs and exclusive local content play will challenge to grow their influence as consumers’ content consumption habits become more personalized.

So, whether you are a TV channel or a VOD platform, your consumers’ loyalty with you is as good as your ongoing investment in new, local, and exclusive content.

What will impact advertising on TV

Over the last few years, the advertising industry have been witnessing a shift in advertising dollars from traditional to digital channels where agencies and media partners are being held more accountable for business outcomes. And till date, the attributable nature and measurement solutions of digital platforms have been pivotal drivers of that shift.

To battle that shift, we have seen Performance TV solutions such as the likes of Brand4mance, but the Linear TV industry needs to evolve further in the long run with attribution and measurement solutions.

Cross media measurement working group is one such initiative by World Federation of Advertisers (WFA), that will look at cross media measurement. But how that will impact the allocation of advertising dollars is far out in the future and is yet to be seen.

However, with the longstanding Ipsos TV measurement expected to be eventually replaced by the People Meter, the industry is anticipating a more accurate and better representation of TV viewership in the region. Which of course, will have a dual impact on advertisers and TV vendors.

For advertisers, it would translate into more advertising dollars required to reach the same number of consumers that they reach today. But for TV vendors, it would further iterate the importance of investment in content production for them to grow their advertising revenue and retain their viewership.

And while SVOD platforms will be strong contenders when it comes to share of entertainment vs linear TV, advertising revenue is not their source of revenue – but this could open branded content opportunities in the future. AVOD platforms however will evolve to strengthen their offering through creator partnerships, content funding programs and their ability to leverage anonymized audience data points to improve performance of media campaigns.

Performance and measurement will continue to dictate investment

The future of advertising on TV looks optimistic with new measurement initiatives already underway. The free-to-air nature of these channels with impactful regional content and affinity also lowers the barrier to viewership.

It will be about who takes more accountability and how the advertising investment is justified against stronger performance driven channels on TV. That will determine who gets to have the bigger piece and eat it too.