Modern Marketing Dilemmas: How Can You Prove Marketing Adds Value To Your Brand?, By Kantar’s Mary Kyriakidi And Jorge Alagon

Co-authored by: Mary Kyriakidi, Kantar’s Global Thought Leader, Brand Guidance, and Jorge Alagon, Kantar’s Global Head of Data Science Innovations

What we all agree on: Marketing’s role is to create value

Value creation is the most important job in any business. Marketers will agree that high-quality marketing can be a key differentiator in driving brand value growth. We could look at a marketer as a value engineer; her job is to create value by meeting people’s needs. The greatest benefit for brands? With an outstanding marketing touch, people will buy more, at a higher price and this will have a knock-on effect on the business’s profit margins. In McKinsey’s research of S&P 1500 companies, it’s estimated that businesses can pocket a further 8% of profit after increasing prices by 1%.

Renowned thought leaders in marketing present a united front when it comes to advice about investing in consistent branding, not halting advertising when finances begin to bite and avoiding sales promotionsthat only give the illusion of increased sales.

In fact, it’s during the toughest of times that the strongest brands actively put value back into their brands. The reason? To be able to sustain customer price perception and price position when consumer decisions get harder.

So, it is not surprising that Coca-Cola – currently enjoying a 12% year-on-year brand value increase according to Kantar’s BrandZ Global report – announced that they are further increasing their marketing spend to create more of it. That surplus investment in marketing was fuelled by their intention to raise their prices.

What we also agree on: Perceptions matter

‘As Jeremy Bullmore and Stephen King debated decades ago when choosing between product A and product B: “most knives cut, but people are happy to pay more for some and they are not deceived in any way”. Essentially, consumers don’t merely consider the function of a product. They want more than that and that extra intangible aspect is a product’s perceived value.

Having evolved from once marking cattle, contemporary branding involves creating a brand in the mind of the consumer – contrary to the tangible product itself being created in the factory. The value we create through such mental connections is not only possible but also has the added benefit of being more environmentally friendly. Vice chair of the Ogilvy & Mather group, Rory Sutherland wittily observes as it “requires a lot less carbon consumption to make something 3x bigger, or 10x faster for example”.

So, perceptions can drive behaviour and that behaviour drives sales. But, more recently, the reverse has been heavily debated too: that sales strongly affect perceptions. Depending on which side of this dilemma a marketer sits on, they are called to decide whether they spend their budget on persuading consumers or instead focus on widening their distribution coverage. Professor Koen Pauwels sheds light on the conundrum of where to invest marketing budget with evidence that finds truth in both theories.

On measurement…we agree to disagree

Most marketers agree that it’s important to measure marketing effectiveness and there is evidence to suggest that its prominence has risen within the business. The ‘what to measure’ though remains well-disputed.

First, the good news: despite the persistent dichotomy between a digital and a ‘plain‘ marketer, almost two-thirds of the marketers we interviewed as part of our Media Reactions 2022 study told us that their ROI measurement comprises a mix of both short-term and long-term metrics – those being sales and brand growth. That’s promising!

But our research also reiterates that data gaps persist: 42% of marketers believe they need access to data they currently don’t have. The data suggests that marketing roles remain binary: 14% of marketers want to expand their performance marketing capabilities, whilst the same number question their business’s overreliance on ROI as a gauge of success. Such were the findings of Marketing Week’s Language of Effectiveness survey.

Still, the most alarming reveal in the study links to marketers’ definition of success. This is deeply rooted in the misconception that advertising is the main (or the only) part of a marketer’s job. Almost three quarters (73%) of brand-side marketers don’t consider that improving brand equity is evidence of marketing effectiveness. Instead, they favour shorter-term gains, such as a triumphant communication campaign. Sigh.

Quantifying the value of marketing

For the last 20 years Kantar has been advocating that brands shouldn’t merely be famous, they should also stand for something meaningful and different. That marketers should go beyond brute salience and think outside the box of mental and physical availability. By doing this, the rewards would be manyfold: more sales, better margins and greater efficiencies…now and in the future.

The common denominator across these benefits is the added value in the brand, the marketing outcome. But how should you go about measuring the impact of marketing?

Measuring the impact of marketing with four key performance metrics

Over the last nine months, we’ve been busy examining our hypotheses and revalidating our Meaningfully Different framework. We reviewed our key metrics and – using new data – we shook up what we knew about the impact they can have on brands. The metrics we use to measure meaningful, different and salient can be combined to help measure and predict sales, future growth and pricing potential. We call these Power metrics.

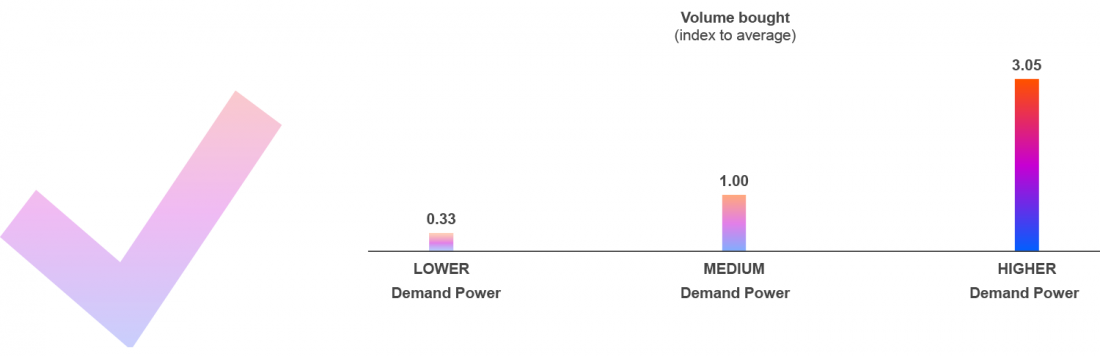

1. Demand Power: Based purely on perceptions of the brand, it measures consumer demand and correlates with market share.

Our validation shows that if you get this right, your brand can capture 9x more volume share than weaker brands.

Demand Power: High Demand Power brands capture 9x higher volume share

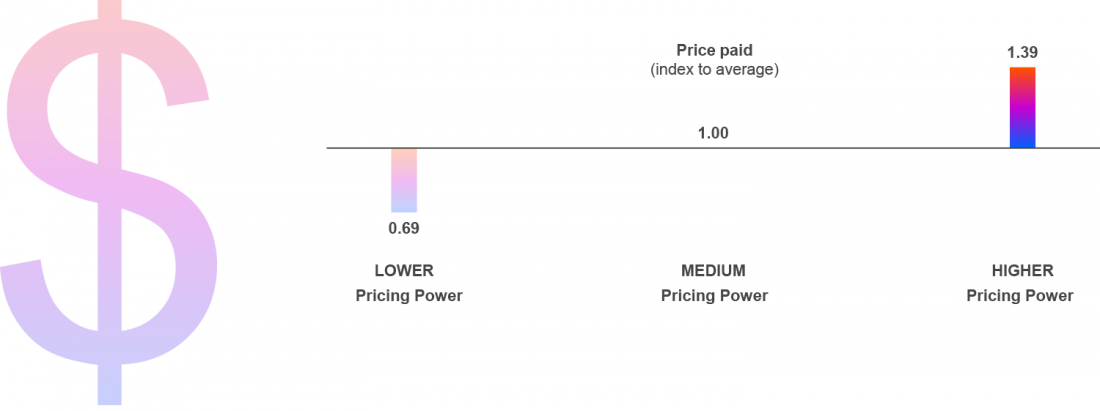

2. Pricing Power: A brand’s ability to justify a price premium relative to the category average, based purely on consumers’ perception of the brand.

Pricing Power is a reflection of price sensitivity and elasticity: the more you have, the less willing a consumer will be to switch to a substitute at a lower price. Our data has revealed that people are happy to pay 70 percentage points more for brands that have high Pricing Power compared with those lacking it.

Pricing Power: people pay 70pp more for the brands with high Pricing Power

3. Future Power: The probability that the brand will grow value share in the next 12 months.

Again, this is based purely on consumers’ current perceptions of the brand. Brands with high Future Power are four times more likely to grow value share than brands with low Future Power.

Future Power: high scoring brands are 4X more likely to grow value share

4. Activation Power. The fourth and last Power is about converting consumers’ predisposition into brand choice.

Brands need to be easy to mind, yes, but they also need to be easy to find. A brand with a stronger shelf presence has a higher likelihood of getting picked. Meanwhile, a brand that’s out of stock suffers an immediate loss of buyers; some of whom may never get regained. Activation Power is the practical application of a brand’s physical connections and availability.

Our initial validation of Activation Power revealed that it can be a catalyst for brand growth: Brands that are strong (Demand Power) and activate well (Activation Power) accelerate their growth 2.5x more than those with weaker Activation Power.

These four headline metrics complement the amalgam of indicators and other behavioural measures (for instance, point of sale data) that help marketers answer the all-important question: is my marketing effective?

The four Power metrics can act as confirmation that you are injecting value back into the brand, that you can sustain and increase your price, and that your future cash flow is in good shape.

The value of marketing in the face of consumer cutbacks

As we move from a jolly period of deflation to the uncertainty of inflation, some will find solace in brand stories that defied all rules in similar times. They will reference the time when Apple introduced the iPhone: ‘it was in the wake of a financial crisis’ marketers will say ‘and despite the several years of recession that followed, people were still standing in lines outside Apple stores’.

Which is true, but also a heavily rose-tinted paradigm. Apple’s case is a gold standard of consumer perceived value to aspire but can’t provide a blueprint for success for every other brand. Instead, strong marketing teams must focus on doing what needs to be done to create brand value. Because you need to keep on feeding the brand perceptions monster with value, to be able to sustain your price position and even defend a higher one during a difficult economic period.

In September Kantar’s Global Issues Barometer research shows that consumers are, predictably, planning to make cutbacks to spending. Naturally, they gave us a long list, but the items clustered in three ways: cutting back on items bought, avoiding buying certain categories of products entirely, and downgrading the brands they buy from.

Even though people will be prudently working on saving money, irrational spending desire will remain all around us. Some brands will be clearer and louder about the value they bring to their customers, giving them compelling reasons to stick around, and even justifying to themselves any splashing out. Or as marketing professor Mark Ritson, summarises this consumer choice: “in order to justify the continued purchase of some premium brands that are deemed different and meaningful enough to retain their place, customers trade down on weaker, less essential fare”.

There you have it – you’ve read the value theory, and you’ve seen its practical application in our freshly validated metrics. Now what remains is to track your brand against them. Understanding the brand value your marketing activity brings to consumers and to your business is quintessential to foster and leverage a strong brand.

Our next stop in the modern marketing dilemmas series is loyalty; the importance (if any) of a loyalty-first strategy, the rising prominence (if at all) of a loyalty scheme and a rewards programme in a brand’s toolkit to navigate the cost-of-living crisis. Subscribe to our newsletter so you don’t miss the next article in the series. And get in touch to find out more.

This article has been originally published on Kantar.