Get Your eCommerce ON: Stock Your Basket With Essential Insights Into Emirati And Saudi e-Retailer Choice, By Kantar’s Ankit Dhingra

By: Ankit Dhingra, Director, Brand & Commerce, Middle East, Insights Division, Kantar

I’ll let you in on a secret: While the increase in global online purchase behaviour was accelerated by the pandemic, the sheer volume of ecommerce opportunities remains largely untapped. With this growth in tech-powered shopping only projected to continue, it’s time to better understand what drives those purchase decisions to ensure your brand stays top of mind – and digital wallet.

But most retailers have more questions than answers in this regard. For example, what’s really driving those purchase clicks and filling those online baskets? Why do consumers make numerous digital shopping trips for the same categories? And most important of all, what’s the current state of play in our Middle Eastern market?

All is revealed in Kantar’s eCommerce ON global study, powered by insights from over 69,000 online shopping trips across 15 categories ranging from consumer goods to electronics. Undertaken in 19 countries including Saudi Arabia and the UAE, it’s a wealth of knowledge into the drivers of everything from online retailer choice to device usage, category priorities and more. This level of detail is crucial because ecommerce is by no means the realm of copy-paste buyer personas, especially when operating across markets.

Filling in the fuzzy outline of GCC online shoppers

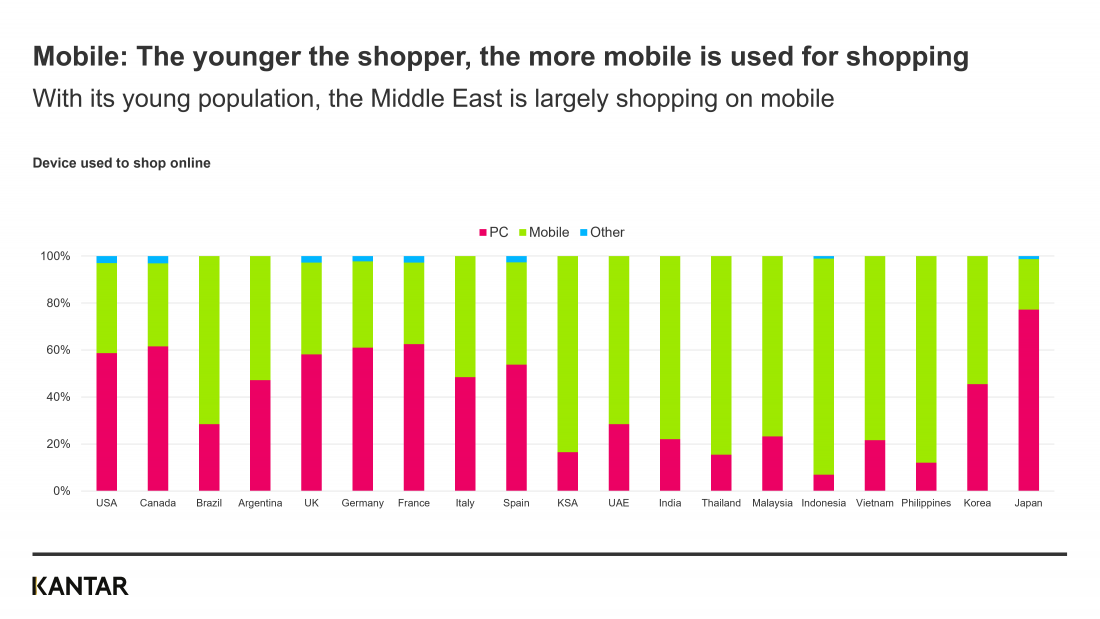

In fact, the rise in volume of online shopping has been the only constant, as shoppers have vastly different needs and decision drivers depending on their different locations. Without specific demographics to align with platforms or stereotypical online shopper behaviour to localise per market, eCommerce ON provides much-needed insight into top categories, platforms, and purchase motivations. For example, with so-called ‘developing’ markets leading the way, we see mobile-first nations like the Middle East leapfrogging the more traditional, though overall smartphones are in the lead as preferred online shopping device for 58% of online shopping trips overall, compared to just 40% on PC.

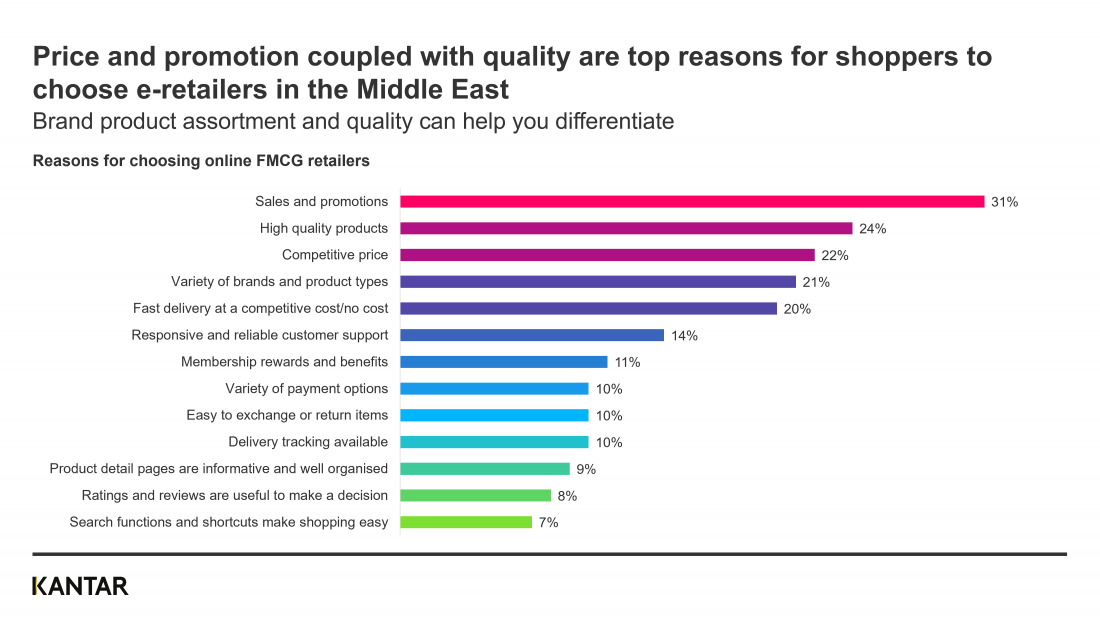

Avoid price wars: Push the button on dominant shopper motivators

Price has always been a top online retail choice consideration, but global inflation and economic uncertainty have only pushed factors like low delivery fees to the top of the list of online retail choice drivers. Beyond this, a successful ecommerce marketing strategy is built from understanding your online shopper and their motivations per brand and category in your country, as these differ even across seemingly similar neighbouring countries.

To keep that competitive ecommerce edge, retailers and brands alike must focus on the specific online shopping values that keeps online shoppers coming back. In the Middle East, this varies from product and brand assortment to product quality, as well as superior customer service.

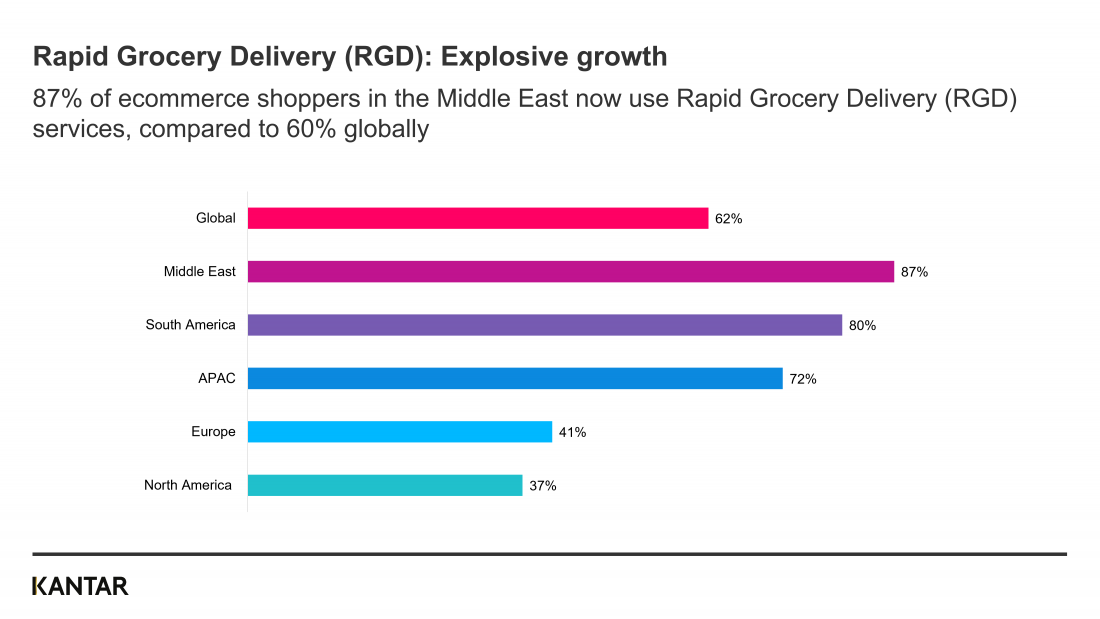

The global data reveals 48% of shoppers choose digital platforms to upgrade or replace electronics rather than for first-time purchase, as well as rebound behaviour for future consumer electronic purchases, but this is lower than average locally in the UAE and Saudi Arabia. Loyalty therefore comes into the mix when shopping for consumer electronics, while the digital purchase of lower-cost FMCG consumer goods is more reliant on how multiple categories interact. The pandemic has also accelerated most ecommerce trends, with everything from rapid grocery delivery (RGD) to meal kit services and second-hand purchasing seeing an uptick in sales.

More than 60% of ecommerce shoppers globally now use RGD services, rising to almost 90% in our region. Looking elsewhere, the higher the shopper age and cost of labour in a market the lower the RGD penetration, leading to a fragmented global RGD market, as UberEats and GrabMart top the worldwide charts with just 7% share of trips each.

Swiping from swift delivery to at-home creation, there’s no denying the popularity of meal kits since the stay-at-home orders took hold. Hello Fresh is the top box in five out of seven markets surveyed. The shift from fast fashion to circular economy saw 34% of online shoppers around the world turn to second-hand online platforms, especially for digital devices, women’s fashion and home appliances purchased by those younger than 35.

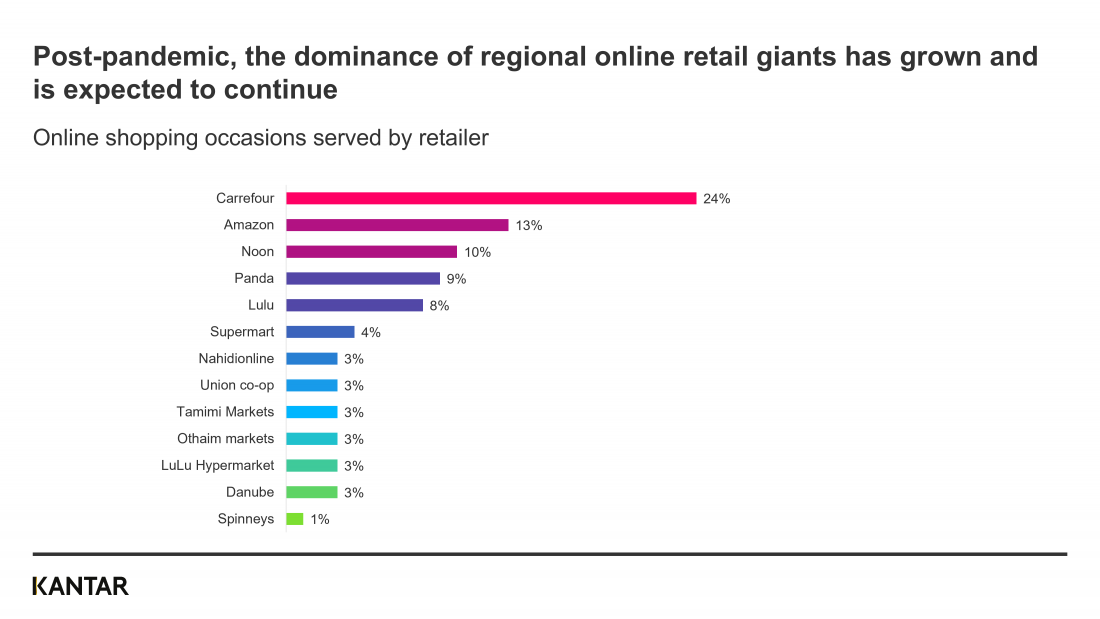

In conclusion, the pandemic has accelerated ecommerce growth by five years across the world. In the Middle East too, we have also witnessed a significant adoption of the digital channels of shopping, with Rapid Delivery Shopping now most penetrated in our region. That said, mall culture is not going away as we have witnessed an increase in store footfall in 2022. What has changed is that shoppers now expect physical retail to provide the convenience of online. Local players have realised this and now dominate key shopping trips. Experience is key and the only real differentiator to win market share in a competitive and fragmented market, so think omnichannel from assortment to experience and fulfilment to drive market growth in the Middle East.

Loading your cart with the drivers of these digital shopper trends makes it easier to click through to cross-platform shopper buy-in and secure your ecommerce strategy success. Download our free booklet to dive deeper into the latest ecommerce trends and get in touch for more detail from our in-depth report on Emirati and Saudi shoppers.