Loyalty and personalization are financial institutions’ most powerful tools to keep consumers happy. When financial institutions lose proximity to their customers through digital disruption, 3rd party services, and super apps, they lose control over growing their business. Keep your customers close with these lessons in loyalty.

In the old world of loyalty, marketers went by the rule of thumb that it’s always cheaper to keep an existing customer than acquire a new one. This adage, so it seems, is nothing more than fiction, as outlined in the myth-busting marketing book, How Brands Grow by Byron Sharp.

http://marketinglawsofgrowth.com/

Embraced by market leaders like Coca-Cola, P&G, and IPSOS Loyalty, decades of research reveal the key to brand growth and revenue is a lot more about making your brand available, salient, and relevant than it is about appealing to a very specific group of loyal users.

It turns out that consumer packaged goods and grocery store sales are a great reference point for financial institutions. Both industries have been disrupted by 3rd party apps, middle man services, and digital innovation.

With all of our access to data and the new ways brands and institutions can connect with consumers, what is the role for loyalty and data in today’s market?

When we know who a person is and what they care about, we as marketers can do a better job at engaging them across channels to make our brand salient and relevant to their needs.

Let’s stick with our comparison of grocery to financial products for a moment. When we know each buyer’s purchase behavior we can not only make recommendations like buying more canned tomatoes because their past behavior implies that they are running low, we can actually make relevant recommendations through content and engagement. For example, knowing what’s in their cart gives us information about their household size and what recipes their family might find interesting.

We can launch entire marketing strategies around who these people are and what their needs might be.

As a bank or financial institution, we can create personalized recommendations paired with past behavior to grow our potential revenue with a customer in a way that feels relevant to them.

Rather than market products and vehicles generically, financial institutions can use consumer behavior to market products that align to consumers’ spending and savings goals.

For example, marketing products can be in the context of saving for a vacation or getting a mortgage for their growing family needs. Based on income or bank account level, we can even specify the types of visuals to reflect a local vacation or an overseas vacation, or a more modest house to a more upscale estate.

When consumers see themselves and their lifestyle in your company’s content, you become more relevant and more important in their daily lives.

While it may seem like we need sophisticated analysis to achieve great loyalty programs, sometimes the solution to collecting and using first-party data is more simple.

People love to feel valued. Sometimes loyalty can be as easy and straightforward as a referral program. Your existing customers can be your greatest asset to reaching new leads.

Simply offering an incentive to your customers in exchange for contact information of their friends and family is a powerful way to generate first-party data. Framing your consumer as a thought leader with great taste can open the door to sharing their friends’ names. An incentive can be as small as a referral bonus for anyone who signs up.

When thinking about the type of first-party data you are after, lifestyle and attitudinal information will help you find ways to increase relevance in your consumers’ lives. Are they growing their family and will need a bigger car? Are they travel-minded and want a great credit card with no foreign fees? Or are they focused on savings and want the best interest rate.

Understanding your consumers’ lives is the key to improving them and meeting their needs.

More and more often, loyalty and personalization is happening in real-time. Your consumers are online and taking action with every click. Consider how your online experience is customized to who the person is and what actions they recently took.

You may even be able to bring this digital experience into real-life moments.

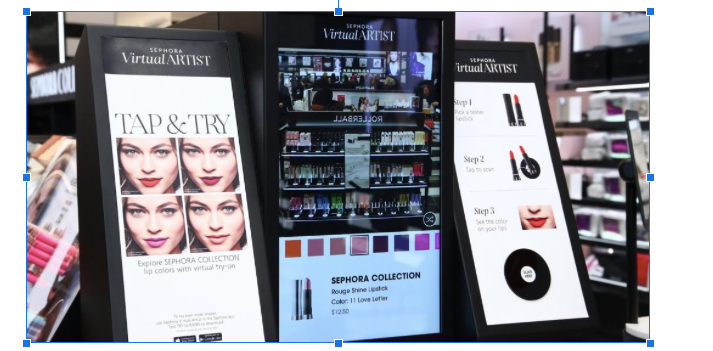

Take for example Sephora, the U.S makeup company. They create a digital experience in-store with virtual makeup applications. While it improves the shopping experience for the consumer, it’s also generating important data, like colors and brand preferences. The store is then able to offer customized recommendations and save user preferences for retargeting later.

McDonalds is another example of a real life footprint that uses digital kiosks onsite that have the potential to improve the order experience and make personalized recommendations depending on customer orders. This in turn increases revenue for McDonalds by increasing order size.

As financial institutions look to modernize amidst the world of apps and onsite technology, consider what elements of the physical experience can be improved with smarter smart screens.

If a customer frequently makes a similar withdrawal, why shouldn’t the ATM guess the amount they want to take out? Conversely, if a customer is consistently making a deposit or receiving a direct deposit, why not provide personalized recommendations in the form of retirement savings vehicles that they may not have considered. This gives financial institutions more relevant ways of promoting their products and deepening the consumer’s relationship within the brand ecosystem.

Our modern world has given consumers control over when and where they want to engage.

If they don’t like grocery shopping at the store, they can use a delivery app. This creates a layer of distance between the brand and the consumer which means less control and less ability to message and market.

It also creates room for error and a negative experience that the consumer will ultimately associate with the end brand, and not necessarily the intermediary app.

As a financial institution, consumers can use 3rd party cash sending apps or go so far as to invest in cryptocurrencies and avoid your ecosystem altogether. If there is a delay or an error, the user could be upset with their financial institution, even if they weren’t the responsible party, and you as the brand will have no ability to correct it.

To keep consumers close, it’s important to offer them ways to engage on their terms.

Improve your app, create an on-premise experience that allows for flexibility and control, and use email marketing sparingly. You can also create incentives to keep consumers coming back, like cashback and marketing promotions.

Consumers will flock to whoever and whatever is most attractive to them

In other words, what makes their lives easier and more convenient? If you as a financial institution can manage to offer better service through using the personal information at your disposal, you can keep consumers happy, and earn their loyalty in the long term. Don’t give them any reason to pull away from you. Make their loyalty more attractive than exploring new territory.