Brilliant Basics To Be Successful In eGrocery

By: Saradha Sethuraman, eCommerce Business Director at Omnicom Media Group

eGrocery has seen a significant boost in growth owing to Covid. Based on a recent report from Bain – even markets which were expected to be the slowest adopters like France, Germany have accelerated and the changes in behavioural habits triggered due to Covid are likely to remain.

This brings up the next question – Are brands and retailers really prepared to address this fundamental shift in shopping habits? Consultants, researchers, agencies, thought leaders have been advocating for years to expect this disruptive change – but not many brands or retailers worldwide are equipped to handle this change.

Amazon is trying to capitalise on this gap in the market and the shift in shopping behaviour by quickly expanding their online Fresh proposition across Spain through Dia, Italy through U2 supermarkets and I wouldn’t be surprised if they expand this offering into markets such as Netherlands and Poland by the end of 2021. This move should supercharge retailers and brands to get their act together and utilise all the tools at their disposal.

How can a brand supercharge their growth in eComerce, and how can retailers help?

By getting the brilliant basics in place – getting the virtuous flywheel working for the brand.

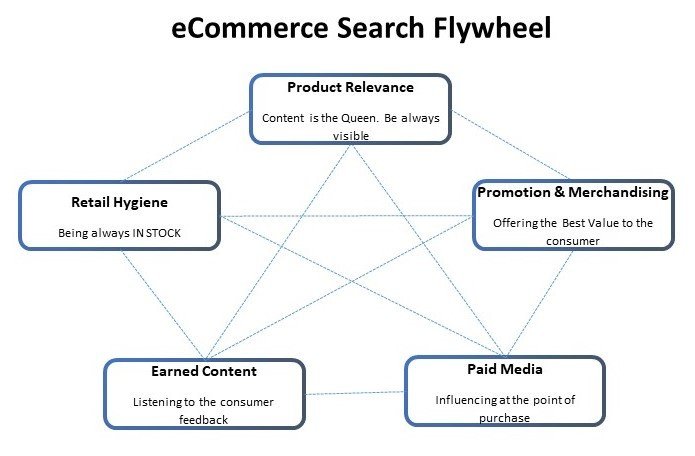

Not the famous Amazon flywheel – but what I call as the eCommerce Search Flywheel. This eCommerce Search flywheel is category and platform agnostic – but given the maturity of e-grocery I see a lot of potential to step charge eCommerce growth by getting the elements on the flywheel working.

Any brand that wants to be successful on Amazon or any eCommerce platform for that matter should consider re-designing their business operations around the Flywheeel and devise innovative ways to ensure that the different elements positively reinforce each other.

The elements of the model, taken individually are nothing new. Each of these elements have part of traditional organisational structures and have proven to function very well in silos. But now in the new world of eCommerce – these silos must break down to create synergistic values that can accelerate growth – as Gemma Spence details in her article.

eCommerce Search Flywheel

Brands should refocus efforts to synchronise their organisational siloes from objectives to KPIs to align the eCommerce Search Flywheel and create significant business impact.

- Product Relevance: How relevant or close can your products be when consumers are searching online? Almost all online platforms are driven by consumer search. They operate through different algorithms, different taxonomy structures – but ultimately are connected to the product through the content that sits within the product detail page.

Brands have to make an effort to understand the retail algorithms and define a methodology to adapt product content to be best suited per platform. This content could be textual such as titles, features, rich content or visual like images and videos.

- Retail Hygiene: How effective is your brand presence in each online retail platform? Good eCommerce platforms always factor in retail hygiene elements such as having the right portfolio of products, product being in stock, being promotable at a given point in time, having the best value before organising search results for a consumer query.

Brands should have a repeatable cohesive audit methodology that can be implemented internally or through third party solutions to provide support to commercial and digital content teams insights needed to check how they perform on various elements of retail hygiene. If automated solutions are being utilised, it is critical to maintain the platform to benchmark against most recent changes in the external environment, at least every half year.

- Earned Content: Under the right circumstances, are you utilising the earned content opportunity available on the platforms? Although often brands do not have a direct control on organic content generated on retail platforms about their products like ratings, reviews and questions – it is important to use every right option available.

Brands should adjust organisations for providing free samples to unbiased consumers to test and review like Amazon Vine, find internal or external resources to answer questions that consumers have raise on the product, or automate the capability to scrape through earned content like commonly asked questions to provide insights on tailoring product content.

- Promotions and Merchandising: Are your promotional deals and events online synchronised with other elements of the flywheel such as content and paid media? Given how budgets are split between advertising, shopper, trade marketing – and managed by stakeholders from different functions, with varying KPIs. Unsurprisingly often when promotional deals are set up, there isn’t the right content on the landing page or targeted paid media – endemic or beyond the platform to support the promotion’s success.

Brands should establish empower cross-functional teams with combined objectives, budgeting processes, media, capability and knowledge and KPIs with the right governance structures.

- Paid Media: Are you supporting your online sales ambitions with the right Paid media on and outside retailer platforms? Does the retail platform offer the best return for investment not only in terms of sales but also in data that can provide incremental insights on performance? Much like any other performance media, investment on a retail platform is measured in terms of Return on Ad Spend or ROAS. These investments are managed either directly by the retailer’s digital teams or through an agency working on the retailer partner – which are sometimes black holes for media investments offering nothing in return.

It is high time for retailers to adapt new ways of working with brands, adopt technology to allow more data access to brands – which can in turn increase investments in formats/platforms that provide the best value.

This clearly is still an evolving space which requires a number of adjustments and innovations from brands, retailers, agency partners, technology solution providers. Every market depending on maturity, buying behaviour will adapt differently to this shift to online retail. eCommerce is here to stay, and whoever wants see a true impact on business growth should be ready to adapt to the new world.