Ten Questions Egyptian Marketers Need To Answer To Spark Brand Recovery In 2021

By: Nermeen Bedeir, Chief Growth Officer for Kantar’s Insights Division in Egypt

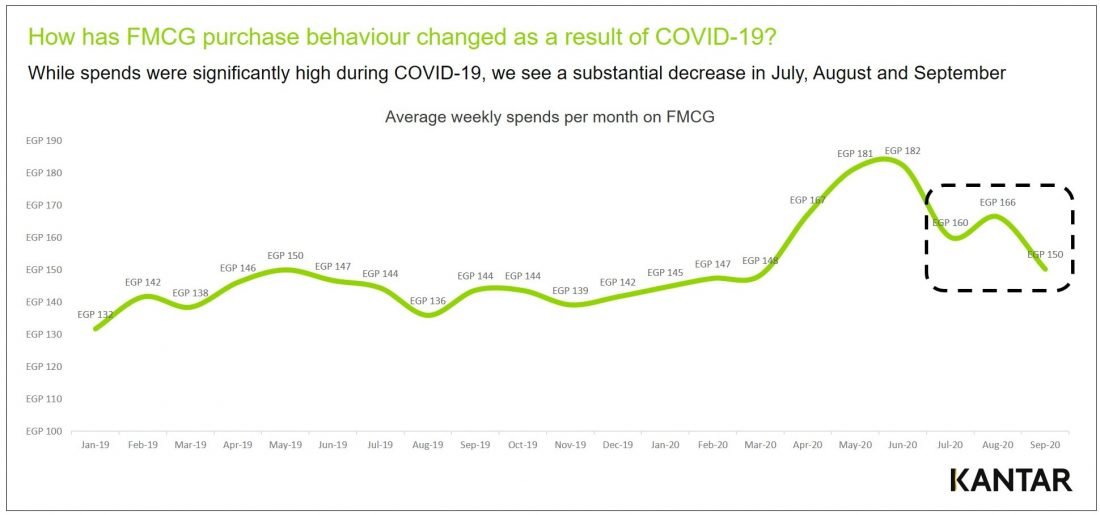

While parts of the world remain under some sort of lockdown and countries are striving to secure their share of one of the vaccines, it seems Egyptians are somewhat over COVID-19. But how did we get here? Rewind to Feb/March 2020 when people all over the world were scared, panicked and confused – Egyptians were no different, despite our relatively moderate anxiety levels compared to the rest of the world. At the onset, consumers were more concerned about hygiene and cleanliness, as well as home and personal care.

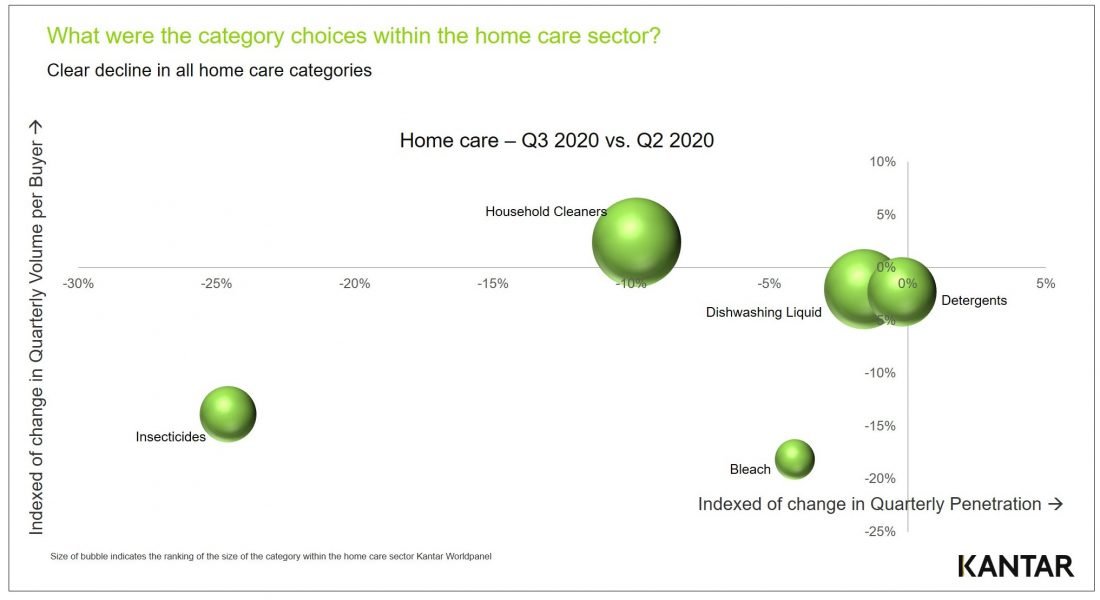

Categories such as bleach, household cleaners and personal wash products therefore saw their market share grow. Some categories had an increase in buyers overall, others saw a rise in volume purchased by each buyer, while others won on both counts. Spend was therefore significantly higher during the early months of the pandemic, resulting in an increase in consumers’ basket size as they stocked up, a behavior not unique to Egyptians.

But as summer peaked post-Ramadan, Egypt saw a substantial decrease in consumer spend with clear signs of a return to normalcy for most categories. This easing of panic buying and stocking up applied to all social classes, especially with families across the country becoming conscious of their lower cash levels and increasing worries about income security.

So, while we can’t claim that Egypt is in a pandemic-induced recession, we can’t afford to make assumptions about what will happen next. And to ensure effective brand strategy, we need to know what is happening right now. How do consumers feel and what are they doing? How are their attitudes and behaviours changing? What might they do next? In order to best anticipate and plan for the future to ensure brand survival and growth beyond COVID-19, we need to consult a continuous stream of data from relevant sources.

With this objective in mind, marketers need to answer ten questions to brace their brands for a full recovery this year. While brands should answer these questions regularly, they become even more important in times of disruption.

Q1: How has lockdown affected your category so far?

The impact will vary depending on whether a brand has been locked out, locked down or locked in. Locked out: Availability has essentially been removed entirely, such as for the airlines and hospitality industry, as well as physical retail and events.

Locked down: People have less need for the category right now, such as automotive, beauty, apparel and luxury.

Locked in: Demand has increased, such as for staple consumer goods, indulgences, food delivery and in-home entertainment.

Not only will lockdown change category demand, it will also change purchase channels as well as out-of-stocks and constrained supply, as new options further change habitual purchasing behaviour. So, while Egypt may not be experiencing lockdown, we don’t exist in isolation. As many other vital countries and markets remain in lockdown, Egypt is therefore still affected.

Q2: Has the changed context also changed category needs and drivers?

Given more time to reflect, people may revise their individual priorities and values. Our COVID-19 learnings indicate that consumer attitudes may be slow to change, and despite no general increase in people looking for the cheapest price, this does vary by category. For example, people are more focused on choosing the right brand when it comes to telecoms and FMCG purchases, perhaps because more price competition meant there was a more level playing field. What will change more easily, particularly if a brand instigates the change with effective marketing, is what consumers regard as important drivers of choice. As Egyptians are increasingly seeking value and not cheaper products, it’s important to understand whether category drivers are changing.

Q3: Has the current disruption affected your brand?

Not every category has suffered because of the pandemic, but even where demand has increased, strong pre-existing brand associations influence which brands benefit most. Leading brands usually benefit from an increase in value market share and are more likely to be chosen simply because they are more available. Yet, smaller brands that are perceived to be more caring, trustworthy and in control may also end up with more than their fair share of growth at the expense of the bigger leading brands, as that’s what’s driving purchase behaviour right now. Pre-existing associations shape people’s choices, so marketers need to reconsider what might be done to change a brand’s standing.

Q4: Are your current customers secure?

When reviewing the status of your brand, start with how your current customers feel in the moment. Do they feel secure, are they likely to stay with your brand and buy from you again? Kantar’s BrandZ analysis that focuses on how brands grow, finds that brands which over-perform across the three stages of the buyer lifecycle, grew by an average of 46% over three years. The foundation to that growth is retaining as many existing customers as possible. Each customer who sticks with a brand is one less new customer needed to drive growth – particularly during the pandemic, where brands need to deliver a positive, meaningful experience to encourage people to buy again. Unless your brand can retain at least its fair share of existing customers, you’ll find it difficult to grow in the future.

Q5: Is your salience competitive?

Brand salience is most likely to change in the short-term, but it is important to new and existing customers alike. Salience falls fast when above-the-line advertising support is withdrawn, followed by awareness of advertising for the brand and total unaided brand mentions. When it comes to impulse or intermittently purchased categories, a lack of salience could well mean the brand isn’t even thought of for purchase. When physical availability is also limited, brands suffer a greater likelihood of decline.

Q6: Is your brand still well liked and meeting needs?

As we move into the medium-term, brands need to assess whether it is the changing context and consumer behaviours or their own activities that have changed their relationship with their customers. Does the brand still meet people’s needs and is it still liked? One of the ways in which meaningful difference helps drive growth is by making people more likely to repeat interacting with it, and a key aspect of ensuring those better repeat rates is being likeable. People are twice as likely to buy a brand again if they like it to start with. Therefore, given an otherwise equal choice, people will go so far as to pay more for a brand they like and will be more likely to buy it again.

Q7: Can your brand equity support your price point?

Post-pandemic, brands must consider whether their brand equity adequately supports perceptions of value. Findings from past recessions very clearly show that when disposable income is limited, people search for the best value, not necessarily the cheapest option.

Q8: Are barriers preventing you from making a sale?

Lockdown has forced a lot of decisions that might normally be made in the moment to become more considered. In part, this is related to the obvious shift to online purchasing. However, we have also observed a shift to people buying from smaller local stores rather than the bigger supermarkets. If ever there was a time when brands need to be available everywhere and easy to buy, this is it.

Q9: Are your marketing activities teaching the right audience?

Even in times like this, brands need to reach out to potential new customers, if only to replace those who have been forced to make alternative choices or decided they can do without. While all brands lose some users over time, the challenge is to minimise that loss and predispose new, potential customers to buy. Not everyone gets to experience a brand directly, so some learn about it from incidental and unconsidered exposure. A new user may come to desire a brand through casual exposure to online content, reviews, sampling, PR, word of mouth and, of course, advertising. To build sales, brands therefore need to reach new customers and influence them to buy, now and in the future.

Q10: Are your marketing activities resonating?

In 2021, people are more sensitive to and appreciative of authenticity. Now, more than ever, it’s important to strike the right chord. Our CrossMedia database reveals clear results globally on the key levers of paid media that drive greater brand exposure, with quality of creative the single largest driver of growth on brand exposure. This poses the question, are we really investing enough time and budget to ensure we create the most compelling content? Not only do we need to get the right message to people, in the right place, at the right time, while understanding which key elements of the touchpoints are likely to gain the most influence on brand outcomes, we also need to ensure that our messages stick.

Even with the vaccine roll out bringing hope of a near end to the pandemic, it is far from certain what will happen next. What is certain is that we can’t assume people will return to their previous behaviours and brand choices. This presents both a threat and an opportunity for category and brand disruption, so it’s crucial to know what consumers are feeling, thinking and doing. With almost weekly changes, the best way to stay in touch with the consumer of 2021 is to ensure your brand tracking is futureproofed with data and systems that provide quick, reliable feedback on changes in your product category.

Data sources: